Types of Agreements and Instruments

Agreements and Instruments

Award documents are legal agreements between the University and the sponsor. Notices of award can be formal contracts, grants, or cooperative agreements. Before accepting an award, GCA reviews the formal document for compliance with University policy. GCA is authorized to accept and sign notices of award on behalf of the University of North Texas.

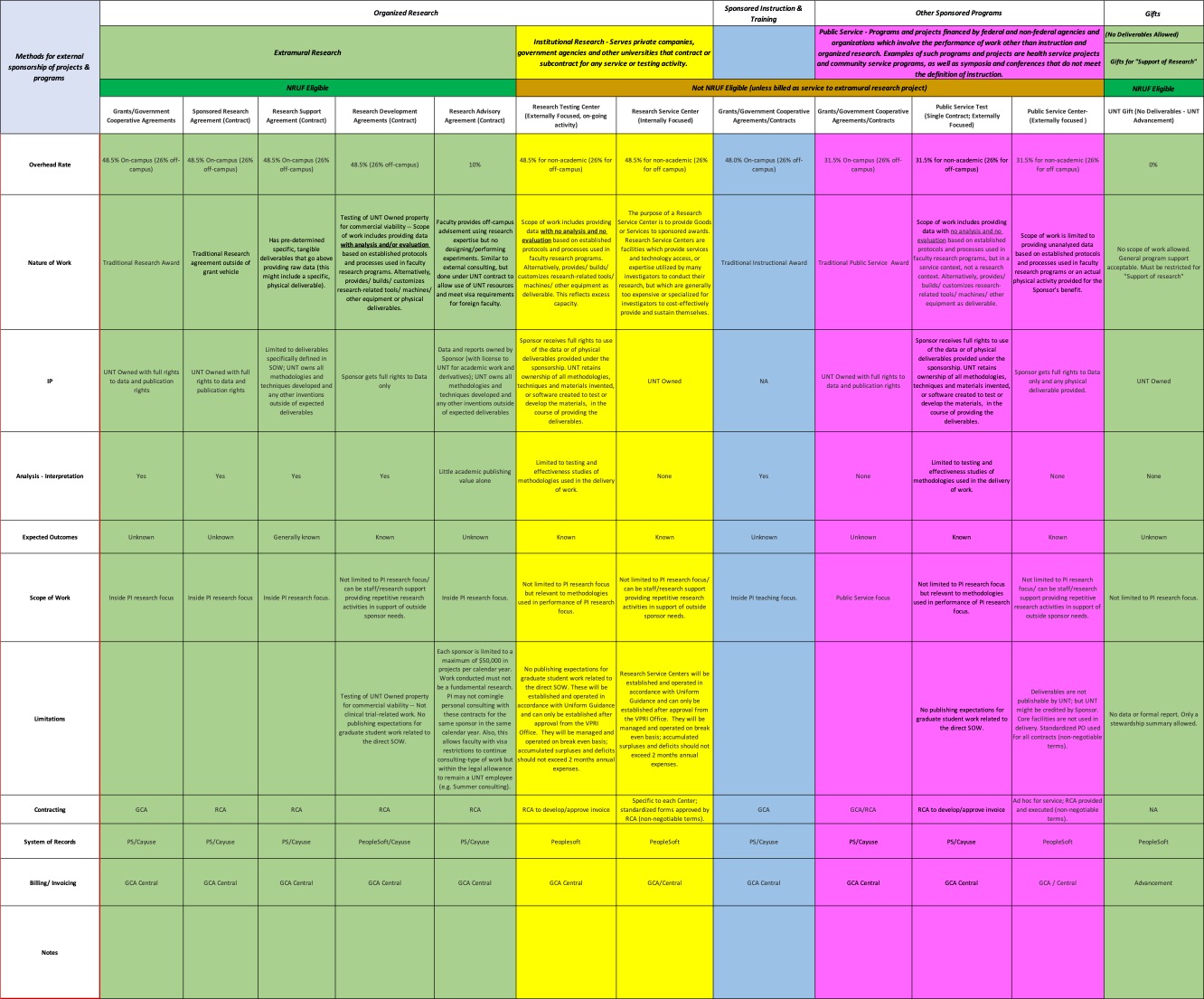

PIs and research personnel are encouraged to view a copy of the locked version of the research sponsorships table.

Grants

Grants

Grants constitute the majority of awards received by UNT and constitute a less-restrictive award type. Sponsors may not require UNT to countersign grants if the terms and conditions are agreed to upon submission of an appropriately authorized or signed proposal. Federal grants are governed by the administrative terms and conditions published, or made publicly available, by the sponsoring agency. Research personnel should always check program announcements and similar documents for referenced terms and conditions.

Contracts

Contracts

Contracts are generally more restrictive awards than grants. Usually, contracts require signatures by both the sponsor and the University to be binding and require defined deliverables on a specific schedule.

The two basic types of contracts are:

- Cost Reimbursable

- Cost Reimbursable contracts specifically state the maximum (not-to-exceed) level of funding that a sponsor will provide. If actual project costs to complete the statement of work are less, UNT will only be reimbursed for actual incurred costs. UNT reports only on costs incurred up to the maximum amount. Additional funding requires contract modification.

- Fixed Price

- Fixed Price contracts are for a specific dollar amount, regardless of the actual cost to complete the full scope of work. The University is paid the full amount specified in the contract. If the PI completes the work for a lesser cost, the University may retain a portion of the amount of funding. If costs are greater than the contracted amount, the University is still required to complete the full scope of work, and the PI becomes responsible for paying the difference (any un-funded costs).Learn more about Fixed Price in Contracts.

Fixed price research contract with residuals

Fixed price research contract with residuals

In some cases, faculty can arrange for Research Contracts based on fixed price performance. Under fix price conditions, the sponsor agrees to pay a set price for the research activities being accomplished in the project. If the expenses of the project total less than the fixed price, residuals are accrued and remain with the institution. Equally, if expenses accumulate beyond the agreed to fix price, then those expenses are carried by the institution. The appropriate risk on both parties is agreed to in executing the contract.

The Cost Accounting Standards are a set of cost principles put forth by the federal government to assure consistency in the costing of proposals that are submitted to federal government. The Cost Accounting Standards Board’s cost accounting standards located at 48 CFR § 9905.501, 9905.502, 9905.505, and 9905.506.are incorporated into the Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (2 CFR 200). It is the expectation of UNT that all research contracts agreed to by this institution are budgeted in accordance with these four standards. 9905.501 is the Cost accounting standard that requires consistency in estimating, accumulating and reporting costs by educational institutions. Given this expectation, this institution expects fix price contracts to be executed with a budget that accurately estimates costs and results in actual expenses that do not greatly deviate from that proposed budget.

Executing a contract with efficiency and effectiveness can yield significant savings and that, in those cases, savings should be realized by the principal investigator and his or her department chair/dean. The reasoning behind the sharing of these resources across the principal investigator, department chair, and dean is that likely institutional capacity was used to create a significant amount of the savings yielded in a fixed price contract. UNT expects that split of residuals to be either based on college/departmental policy or negotiated on a contract-by-contract basis.

Given that UNT research/contracting expects to function in the cost accounting principles of truth in budgeting, we will allow up to a maximum of 25% of budget to be captured in expense residuals. Any balances beyond the 25% will be deemed as outside of expected norms and will be utilized by the VPRI to promote university wide research programs. The intent is to ensure that the university promotes the highest level of accuracy in proposal budgeting practices.

When material levels of residuals are captured in the contract process through efficiency and savings, those residuals are to remain in the sponsored project and spent out of the sponsor project in order to further our capture of those expenses as research expenditures. Immaterial levels of residuals are reasonable to remove from the project and placed in a designated account. Intent to transfer to a designated account will be done with the approval of the AVP of Grants & Contracts Administration.

Cooperative Agreements

Cooperative Agreements

Cooperative Agreements are used when federal sponsors want to retain more active involvement in the conduct of the project. This active oversight may be evidenced by a higher level of agency program advising on the direction of the project, more frequent reporting, or other similar circumstances.

Issues Requiring Special Consideration

Issues Requiring Special Consideration

Research personnel and PIs should be aware of both export controls and HIPAA protocols. These issues require special handling and could impact proposals and research plans.

Export Controls

Export Controls

Export Administration Regulations (EAR, enforced by the Department of Commerce) and International Traffic in Arms Regulations (ITAR, enforced by the Department of State) are Federal regulations which, for reasons of national security or protection of trade, prohibit the “export” (defined very broadly as any oral, written, electronic, or visual disclosure, shipment, transfer, or transmission of a commodity, technology, or software/code) of certain technologies without a license, unless an exception applies. If research at UNT involves such technologies, these regulations may require UNT to obtain prior approval from the State or U.S. Department of Commerce before:

- involving international students or faculty in the research;

- working with international companies; and

- sharing research results with persons who are not U.S. citizens or permanent residents.

These restrictions apply to work physically done on-site at UNT.

These requirements may undermine publication rights, dissemination of research results, and international collaboration. Violations of the regulations may result in severe penalties.

Proposals and awards containing such terms and conditions, or involving research implicated by export control laws, should be identified as early as possible.

HIPAA

HIPAA Protocols

The Health Insurance Portability and Accountability Act of 1996 (HIPAA) is a federal law which went into effect April 14, 2003. The law includes provisions designed to protect the privacy of individually identifiable patient health information.

According to the final regulations, healthcare providers, such as the University of North Texas Health System, can use and disclose protected health information (PHI) only for certain specific functions: treatment, payment, and healthcare operations purposes. For all other purposes, such as research purposes, PHI may only be used or released with the written consent of the impacted individual (authorization) or by application of a specific exception.

Certain parts or “regulated entities” within UNT, as part of their integral function, provide healthcare or health plan services and will need to use and disclose PHI on a routine basis. These regulated entities include UPHS/SOM, the Nursing Clinic LIFE, SODM, Student Health, and the employee health plan. Accordingly, specific policies and procedures have been developed and implemented for any use or disclosure of PHI by these entities.

Proposals that anticipate the use of PHI or otherwise implicate HIPAA concerns should be carefully reviewed. In such cases, faculty should identify any research proposals being submitted to GCA that do contain PHI so that these may be given special attention and handled in accordance with HIPAA regulations.