Outcomes

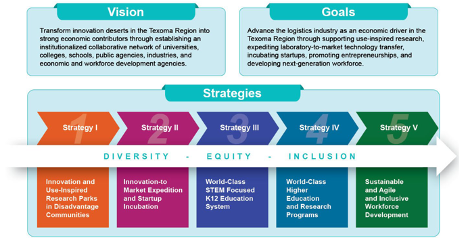

Five interconnected strategies are crafted to achieve the vision and overall goals. We will adopt an integrative process to facilitate cross-domain inter-dependency exploration, knowledge sharing,and convergent theory derivation to develop the Texoma Innovation Engine. The process mimics puzzle-solving techniques, which iterates between two main tasks: (1) analyzing the different strategies and their tactics (pieces of the puzzle) to learn their endogenous and exogenous attributes; and (2) connecting these tactics to develop the entire engine. These strategies and their tactics are summarized as follows.

Each of these strategies, supporting tactics, and outcomes are described in the following section:

-

Strategy 1: Establishing Innovation and UIR Parks in Disadvantaged Communities

(T11) Innovation Deserts and Disadvantaged Communities in TR: Efforts will be dedicated to characterizing the region to clearly identify innovation deserts and evaluate their potential for success. (T12) Innovation Parks with High Regional Return on the Economy: As the core of the Engine, we will plan for the establishment of several innovation parks in the identified innovation deserts commensurate with their location and capacity. Cities, counties, and economic development engines will lead this planning effort to ensure that the proposed innovation parks land in suitable locations. (T13) Key Activities in the Innovation Parks: The set of hosted activities and allocated resources for each innovation park will be planned, including the research domains and projects, business incubation capabilities, and diversity/ workforce training activities. (T14) Management Models of the Innovation Parks: We will review and examine the suitability of different models (e.g., structured and organic) to manage the proposed innovation parks. In particular, we will explore the Skunk Works model and study how and if it can be adapted to flourish in innovation-desert-based innovation environments.

-

Strategy 2: Innovation-to-Market Expedition and Startup Incubation

(T21) Startups Selection and Incubation: We will set the criteria for startups eligible to be supported by the Engine and fully incubated in one of the established parks. These criteria are business studies that determine the potential for success and the resources needed. (T22) Supporting Technological, Business, and Legal Resources: This activity will determine the technological, business, and legal resources required to support incubated businesses, examine their viability in the region, and estimate their costs. (T23) Market Studies and Venture Capital Resources: This activity plans how to develop the capabilities to conduct market studies and establish connections with venture capital for the Engine's incubated startups. (T24) Expos and Networking Events: The Engine will organize technology expos and networking events that bring together all stakeholders. These expos will be opportunities to demonstrate products, exchange ideas with peers, and receive feedback from experts and end users.

-

Strategy 3: Developing a World-Class STEM-Focused K12 Education System

(T31) STEM-Focused Curriculum Design for High and Middle Schools: The Engine's participating universities and colleges have renowned logistics and engineering programs with solid relationships with the region's school districts. They will lead the planning effort for developing a K12 STEM-focused curriculum that increases students' curiosity about technology and research. (T32) Teacher Training on Emerging Technologies: The capabilities of these programs will be extended to design state-of-the-art training programs for teachers offering these curricula. Training programs in conferences, workshops, and laboratory experiences will be planned. (T33) Internships for Students in Research Laboratories: Internship programs will be designed to allow high school students to work on use-inspired research projects, enabling students to learn about research and workforce careers and the value of their education in supporting innovation and entrepreneurship. These programs will be planned such that the participation of students from ISDs serving disadvantaged communities will be prioritized. (T34) STEM Summer Camps and Weekend Activities: Summer and weekend activities will be planned to widen student participation in hands-on STEM activities. These programs will be offered to thousands of students with an emphasis on attracting minority and disadvantaged students

-

Strategy 4: Promoting World-Class Cross-University Higher Education and Research Programs

(T41) Cross-University Collaborative Research Centers: TIE will augment regional universities' capabilities by eliminating boundaries and facilitating collaboration among researchers in multi-university centers. (T42) University-Industry-Public Sector Partnerships: Mechanisms for partnerships among universities, the industry, and the public sector will promote use-inspired research activities that lead to economic-impactful innovations. (T43) Use-Inspired Research and Technology Transfer: The Engine will facilitate and support use-inspired research projects through partnerships with the logistics industry, focusing on innovations in automation, electrification, and cyber technologies. (T44) Entrepreneurship Training: The region's participating community organizations and the universities will leverage existing entrepreneurial training programs to support innovation-driven entrepreneurship and business development

-

Strategy 5: Sustainable and Agile Workforce Development

(T51) Industry Needs and Workforce Upskilling Requirements: Through continuous dialogue with industry representatives, skill needs and workforce shortages will be characterized across the industry layout. (T52) Partnerships with Universities, Colleges, and High Schools: The Engine will establish the mechanism for workforce development agencies to partner with universities, colleges, and high schools in the region to design and offer training curricula that meet industry needs. (T53) Developing Agile Training Courses and Programs: The logistics industry and its supporting technologies are fast-evolving, requiring the capabilities to develop agile training models and programs that quickly respond to the industry's needs. (T54) Training the Trainers Programs: Developing programs to train workforce trainers is essential to scaling workforce training across TR.

Broader Impacts

This is the right time to create a high-impact engine in the TR innovation with a governance structure that ensures the highest probability of success by:

-

Targeting a Major Industry

As North America's largest inland port, the TEXOMA region represents a key logistics hub for future North American trade and economic growth. The region is home to DFW, ranked fifth in gross metropolitan product at $608 billion. The region is the fourth largest in total freight tonnage and fifth in value. Three Class 1 railroads serve the region with over 500 miles of railway. The region is the fourth largest intermodal rail hub lifting over 1.4 million containers in 2020. If an ocean port, the region would rank seventh overall in container lifts. The region is uniquely situated to support North American distribution. Trucks can reach DFW in one day from Mexico and over 80% of the US population in two days. Intermodal rail provides 48-72 hour service from the West coast. Due to its location, many corporations have distribution operations in the region with over 826 million square feet of warehouse space. Two major airports, DFW International Airport and Perot Field Fort Worth Alliance are among the top cargo airports in the country (#11 and #20, respectively) enabling the region to “plug and play” in the global transport of expensive electronics, with over $83 billion of imported goods clearing the DFW customs district in 2021

-

Preparing for Unprecedented Industry Growth

The Texoma Region (TR) will experience significant growth in transportation and logistics volumes which poses major challenges to the efficient and timely movement of freight. The region currently moves over 886 million tons of freight valued at over $1.1 trillion annually. These volumes are forecasted to significantly increase with over one million daily truck trips forecasted for 2040, and freight tonnage increasing by 50 percent and freight value increasing by nearly 80 percent over the 2020-2050 timeframe. Three of the most bottlenecked truck intersections (ranking #8, #54, and #60) lie in the DFW region. Truck congestion has significant implications and environmental consequences to the region's economy as it added over 6.2 million person-hours of truck delay with an annual truck congestion cost of $330 million. Congestion in the region also poses a significant cost to commuters with the region ranked 5th in annual person-hours of travel delay in 2020 with over 136 million hours, 52 million gallons of excess fuel consumed, and an annual commuter congestion cost exceeding $3 billion. Bringing the TR innovation deserts surrounding this vibrant logistics ecosystem into this ecosystem is essential for its continuing vitality.

-

Building on Ongoing Institutional Collaboration

Within TR, aggressive economic development teams, universities and many other key partners are working to build relationships with their northern and southern neighbors. The region has recently established the North Central Texas Center for Mobility Technologies, a collaborative effort among four major universities in North Texas, industry, and the public sector to promote use-inspired research addressing regional and national mobility challenges. The Choctaw Nation in Oklahoma, has signed a Cooperative Development Agreement with the University of North Texas, has established 44,500-acre urban air mobility testing range, and has multiple agreements with the FAA including being the sole tribal government lead participant on the BEYOND program. The Southern Dallas County Inland Port Transportation Management Association, its location in the historically marginalized Southern Dallas region, and the strong collaborative relationship between the inland port and universities, colleges, logistic companies, municipalities, communities, and workforce development agencies open tremendous opportunities for using the port as another living laboratory and a major component of the proposed engine. Macroeconomic forces and developments within TR make this an ideal time to institutionalize and focus the collaborative relationships to address the societal and economic challenges in the region and nationally.

-

Benefiting from Booming Automation, Electrification, and Cyber Industries

As noted, TEXOMA is anchored on its southern boundary by DFW, one of the most active centers of economic growth among metropolitan areas in the U.S. DFW added 950,000 new jobs between 2010-2019. During the height of the COVID pandemic, the region saw less of a percent decline in employment, recovered to pre-pandemic employment totals faster, and currently has the highest rate of year-over- year employment growth (7.2%) among the largest competing markets. In large part, the employment picture reflects the business and talent recruitment and retention strategies among economic development agencies in DFW. The impact of this final strategy is found in the nearly 42,000 new high-tech jobs created in DFW from 2017-2022, second most in the U.S. to the Bay Area.